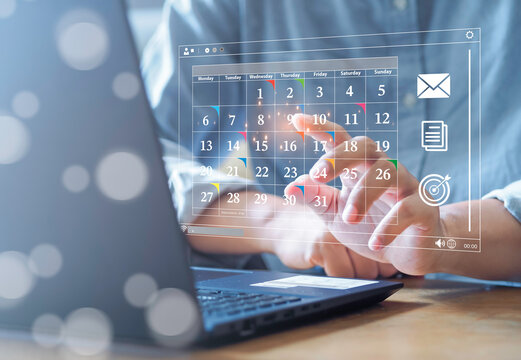

Policy Readiness 2026: A Practical Operating Plan for Small Businesses

Translate shifting policy into clarity: disciplined calendars, simple SOPs, and transparent reporting that protect margins and community trust. January 2026 is a planning month, not a guessing month. For small businesses, policy risk is an operational risk—permits; compliance updates, and procurement timelines affect cash flow and hiring. The solution is practical: organize what you can control, […]

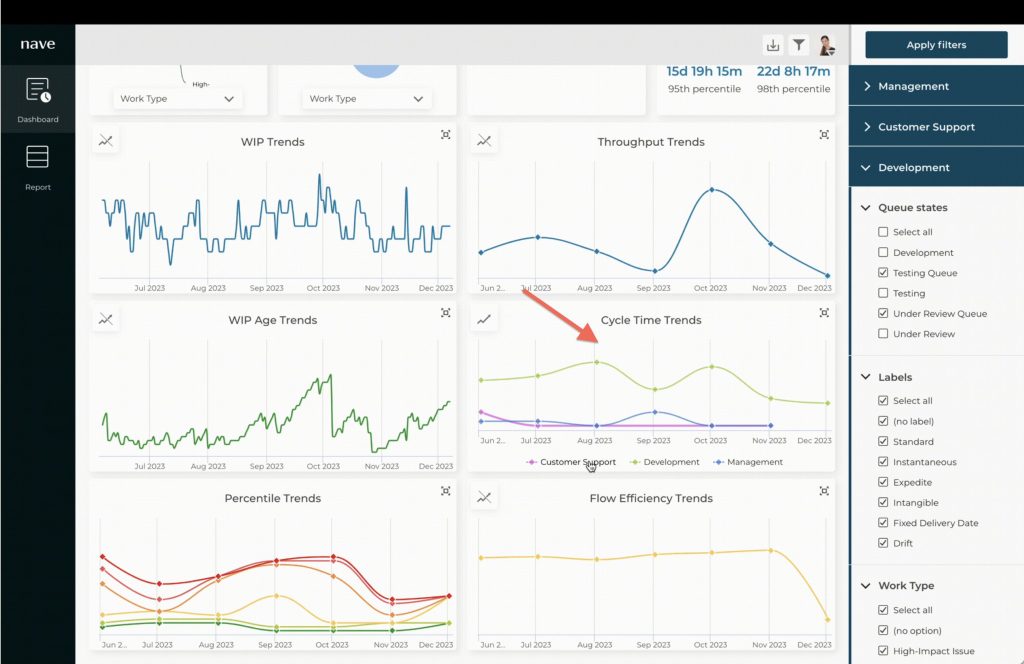

Operate With Proof: A January Briefing for Focused Founders

How disciplined operating reviews, cash protections, and people systems convert early‑year uncertaintyinto momentum in 2026. Founders do not need forecasts; they need operating truth. As 2026 begins, the advantage goes to teams that formalize review cadence, protect cash, and translate narrative into measurable execution. The standard is proof—plans, owners, and dates you can defend in […]

Stewardship First: A January Playbook for Values‑Aligned Wealth

Practical disciplines to protect cash flow, document impact, and fund what matters in 2026. January invites sobriety and stewardship. In a year that may reward prudence over bravado, executive households and owner‑operators can strengthen wealth by aligning cash discipline with community outcomes. The goal is simple: preserve optionality, fund what matters, and prove impact with […]

Editorial Ops That Scale: A Clean Growth Model for 2026

Build a narrative business on disciplined editorial processes, respectful author care, and transparent metrics that convert craft into repeatable revenue. January 2026 invites founders of creative businesses to run on systems, not adrenaline. In publishing and content services, growth is earned through editing quality, author support, and schedules that are held under pressure. The operating rule is […]

Care Briefings: Build a Podcast That Honors Caregivers and Delivers Outcomes

Structure the show like an operating asset with duty of care—clear intent, predictable cadence, and measurable effects executives can defend in 2026. January favors leaders who operate with clarity and compassion. An executive podcast must serve people and performance: protect guests and staff, publish on schedule, and prove value beyond download counts. Treat the show as an […]

Clean Operations, Clear Outcomes: Senior Care Business Priorities for 2026

In early 2026, operators that standardize cleanliness, staffing visibility, and family communication earn durable trust and audit-ready proof. January 2026 is a checkpoint for senior care businesses. Families expect dignity and visible standards; staff need fair schedules and clear protocols; regulators require records you can defend. The responsible path is not flashy—just consistent governance that […]

Templates That Win: A January Operating Plan for Signal‑Driven Marketing

Systemize outreach with clean assets, disciplined cadences, and proofs that connect campaigns to pipeline health in 2026. January favors clarity and repeatability. Marketing that compounds is built from clean templates, disciplined cadences, and evidence that ties effort to real conversations. Treat outreach like an operating system: simple, consistent, and measured. Start With the Signal You Will Honor […]

Operational Tech Discipline: A Safer, Smarter Assisted Living Stack for 2026

Align staffing, compliance, and resident experience with right-sized technology, disciplined governance, and outcomes executives can defend. January 2026 favors operators who pair empathy with rigor. In assisted living, technology is not decorating; it is a system of record, alerts, and workflows that protect residents, support staff, and satisfy regulators. The winning stack is practical—clear roles, simple […]

Read for Return: A Finance Leader’s Spotlight on “The Working Capital Field Manual (2026 Edition)”

An operator’s reading note: how to convert a practical finance playbook into cash protection, audit‑ready governance, and team habits you can sustain this year. I read business books with a pen and a spreadsheet. In January 2026, I am interested in playbooks that respect constraints and produce audit‑ready outcomes. The Working Capital Field Manual (2026 […]

Credit That Works: A January SOP for Owner‑Operators

A process‑driven approach to business credit: clear scope, compliant terms, and measurable cash protection for 2026. In January, discipline beats its appetite. Business credit should serve operations, not distract them. The test is simple: can your credit arrangements be read, audited, and linked to outcomes on one page? If not, redesign the process before you […]